Tips To Maintaining Financial Bliss In Marriage

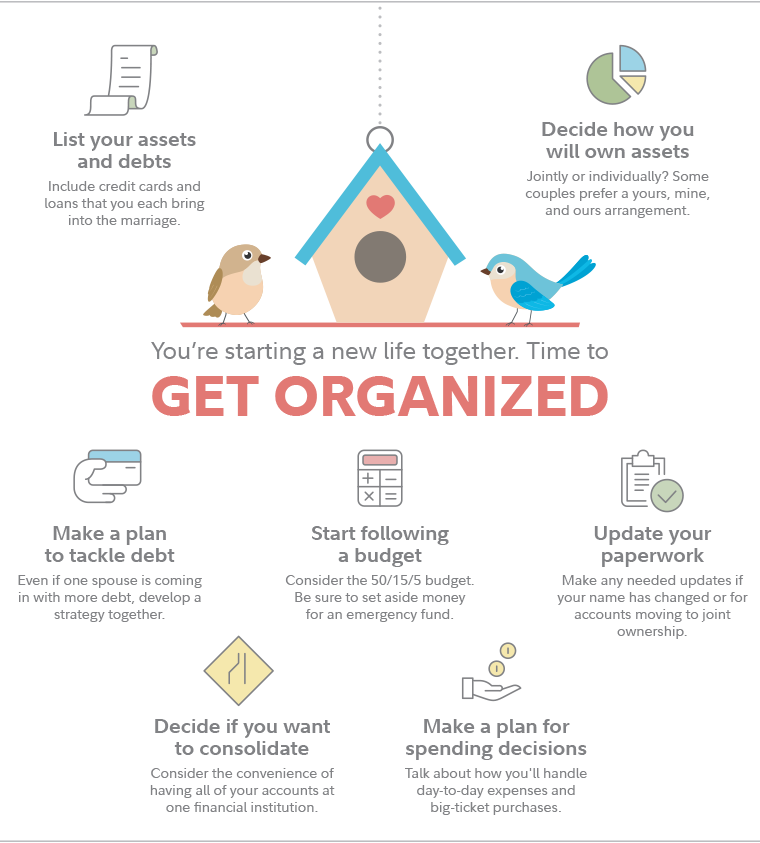

1. Give Yourselves a Financial Checkup

Before entering into marriage, it is crucial for couples to understand each other’s financial situations. This includes discussing income, debts, spending habits, and financial goals. By having an open conversation about finances, couples can identify potential issues and work together to address them before they become significant problems.

2. Understand Your Partner’s Debt

It is essential to be aware of any existing debts your partner may have. Understanding the nature and extent of these debts can help in making informed decisions about merging finances. If necessary, couples should create a plan to pay down debt together while maintaining separate accounts until the debt is managed.

3. Save for the Wedding and Beyond

Once engaged, couples should start saving for their wedding and future expenses. Experts recommend saving at least 10% of combined income each month. This savings plan should account for wedding costs as well as future goals like a honeymoon or home purchase.

4. Create a Budget You Both Can Live By

Developing a comprehensive budget is vital for financial harmony in marriage. Couples should gather all financial documents and calculate monthly expenses against their combined income. Setting spending limits on discretionary purchases can also help prevent conflicts over money.

5. Decide Who Manages What

Assigning specific financial responsibilities can streamline money management in marriage. One partner might handle day-to-day expenses while the other focuses on long-term investments and retirement planning.

6. To Combine or Not to Combine?

Couples must decide how they want to manage their finances post-marriage—whether to combine all accounts, maintain separate accounts, or use a hybrid approach that includes both joint and individual accounts.

7. Update Your Beneficiaries

After marriage, it’s important to update beneficiary designations on life insurance policies, retirement accounts, and wills to ensure that your spouse is recognized as the primary beneficiary.

8. Change Your Withholdings

Married couples have the option to file taxes jointly or separately; thus, reviewing payroll withholdings after marriage is necessary to optimize tax benefits.

9. Have a Financial Date Night

Regularly scheduled discussions about finances can foster transparency and accountability in managing money as a couple. Setting aside time each month allows partners to review progress towards financial goals and make adjustments as needed.

10. Tell Your Bank if You Change Your Name

If either partner changes their name after marriage, it’s important to update this information with banks and investment accounts to avoid complications in accessing funds or managing accounts.

By following these tips, couples can build a strong foundation for financial stability that enhances their relationship satisfaction over time.

0 Comments